MARKING FIVE YEARS

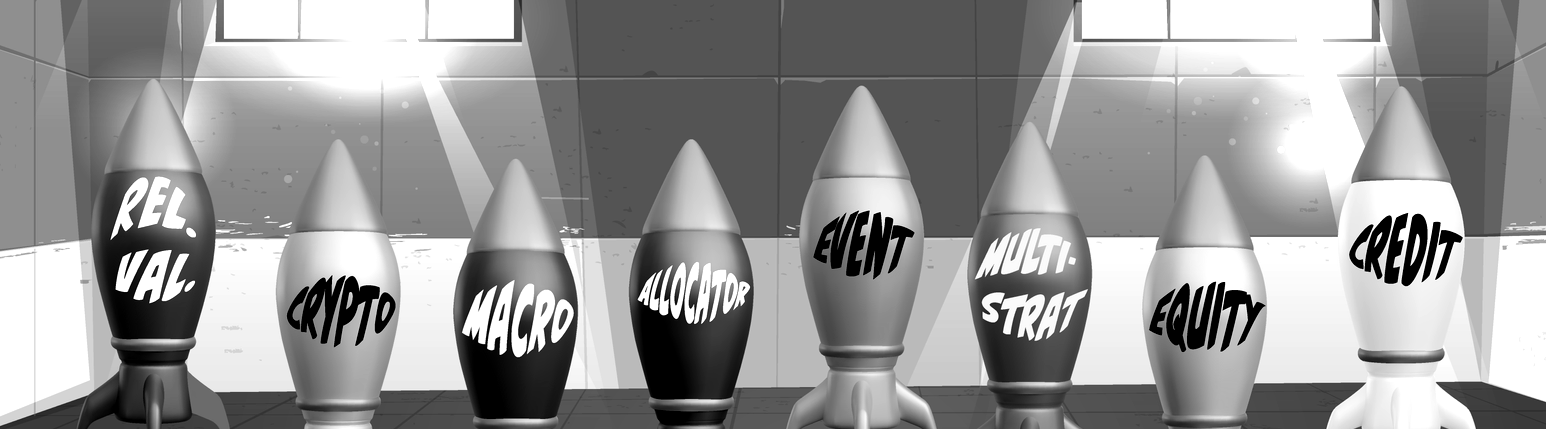

Every pathway to absolute hedge fund industry transparency begins with sweeping access to global hedge fund launches

Hedge Scout conducts early and comprehensive research on hedge fund launches

The approach leverages two decades of experience in hedge fund database development and manager research. Since 2020, we have profiled over 4,000 manager launches—roughly 90% of all new hedge fund managers, making Hedge Scout the industry leader in hedge fund research and intelligence.

Hedge Scout delivers essential research for hedge fund analysis, fund and SMA allocations, manager seeding, portfolio manager tracking, recruitment, manager monitoring, benchmark and peer group construction, and filling fund database gaps.

Hedge Scout can boost hedge fund coverage and research productivity by a multiple while addressing critical intelligence deficiencies experienced by nearly every institutional allocator.

THE LONGSTANDING PROBLEM

Allocators seek optimal hedge fund returns but lack access to performing hedge fund managers

Even well-resourced institutional allocators lack visibility into the majority of global hedge fund managers

Established Hedge Funds Data Deficit

- Hedge fund data vendors capture only a fraction of the global hedge fund universe because manager participation is voluntary.

- Amalgamated data from six major industry databases exclude 44% of hedge funds with assets under management (AUM) over $150 million.

Established Deficit: Annual Cost

- Hedge funds listed in databases have underperformed by -2.64% est. in net annualized rate of return (RoR) compared to non-listed funds over a four-year period.

Emerging Hedge Funds Data Deficit

- More than 70% of hedge fund launches and emerging managers are absent from database records due to strategy incubation, marketing strategy, and privacy concerns.

- Most hedge funds will never disclose their info to a hedge fund database.

Emerging Deficit: Annual Cost

- Established hedge funds have underperformed -5.26% est. in net annualized rate of return (RoR) compared to younger funds over a 10-year period.

Deficient hedge fund data and intelligence not only impair absolute and relative performance but also undermine the legitimacy of any hedge fund search, research, analysis, benchmarking, and portfolio optimization, exemplifying the principle of

THE SOLUTION

Early access to global manager launches is the foundation of hedge fund research and investment

Hedge Scout delivers continuous, institutional-grade research on hedge fund launches and emerging managers through an intuitive online platform

Comprehensive

Hedge Scout can boost your group’s hedge fund coverage by a multiple. Our comprehensive approach delivers the big-picture, backfills database gaps, informs on new and evolving strategies, optimizes peer analysis, and strengthens the legitimacy of manager due diligence while promoting better investment outcomes.

Early

Hedge Scout deliberately identifies new launches early, with many profiles predating service provider selection. Monitor strategy and performance from 'day one,' reducing data biases—such as backfill or instant history—by up to 80%+, while opening the door to early investor fees, favorable liquidity terms, and capacity.

Exclusive

Find hedge fund managers and industry intelligence unavailable elsewhere. Approximately 90% of our research is exclusive at the time of release, providing your group a decisive edge in hedge fund searches, strategy research, and understanding evolving industry dynamics.

Prescient

Track emerging macro and micro industry developments, including new and evolving hedge fund strategies, portfolio manager and other key departures, fundraising, seeding, allocation decisions, geographical trends, and other key developments.

Productive

Hedge fund analysts spend 20–25% of their time searching for and engaging with new managers. Hedge Scout delivers continuous research on new hedge funds, enabling your team to focus on other pertinent matters.

Efficient

A fast, continuously updated research platform, optimized for mobile, featuring an intuitive design and search interface offered at the cost of analysts traveling to an industry conference.

MARKING FIVE YEARS OF

Excellence in Hedge Fund Search & Research

Hedge Scout's innovative approach has consistently delivered industry-leading hedge fund research

5+

Years of Research

4,000+

New Managers Profiled

90%+

New Manager Capture Rate

75%+

Funds Profiled Pre-Launch